How do I get receipt of Amazon fees?

I need a good receipt for my accounting regarding the monthly payment for Amazon. One with business id of Amazon and my company, names, tax breakdown (should be 0% but Amazon steals the taxes too), etc information that is mandatory at least here in EU.

I already tried twice reporting issue, and all I get from those bots is Payment report, which is nothing of the kind. It doesn't have the information regarding tax base nor parties involved.

Any other EU sellers here? How you do your accounting when using Amazon?

How do I get receipt of Amazon fees?

I need a good receipt for my accounting regarding the monthly payment for Amazon. One with business id of Amazon and my company, names, tax breakdown (should be 0% but Amazon steals the taxes too), etc information that is mandatory at least here in EU.

I already tried twice reporting issue, and all I get from those bots is Payment report, which is nothing of the kind. It doesn't have the information regarding tax base nor parties involved.

Any other EU sellers here? How you do your accounting when using Amazon?

0 replies

Seller_CW0P5hgbsiqWX

Your business in the USA should be registered in one of the States.

- Amazon will collect the sales tax from the buyer and submit it for you.

- You should have a Federal EIN number to which Amazon reports your earnings. You should have on file the IRS form W8-BEN. That form is what foreign companies use to state all profits earned will be exported outside the USA to the Home Country for accounting there.

__________________________________________

- If you need exact accounting for every transaction, run a transaction report.

- If you need the name and address of every sale purchased, save a PDF copy of every invoice.

Seller_rI7BZIczK8iAC

First of all you are not looking for a "receipt" but for an "invoice".

Read following thread, anything is said:

Read also the thread I posted there.

Steve_Amazon

Hi @Seller_iB6NOYY5J6c1T,

Steve from Amazon here, thank you for reaching out. In reading through your thread, it appears that this issue may be occurring in the EU store. If that is the case, please change the store in your Forums account to the UK and create a new post explaining the situation you are facing in detail. This process will engage a Community Manager in that store and they can engage the proper support team.

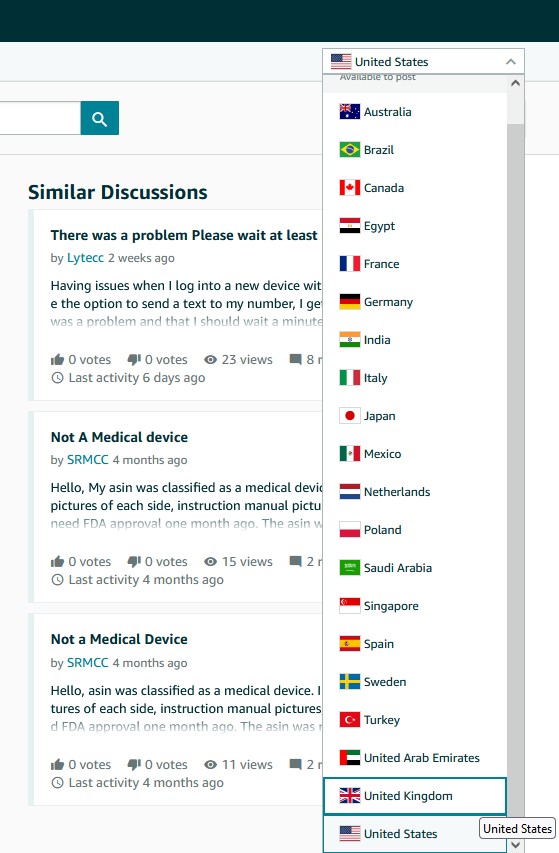

You can change the store in the Forums by clicking the drop down box in the upper right hand corner and selecting the UK store as illustrated below.

Please let me know if there are any questions.

Thanks,

Steve