GST/HST collection by seller or Amazon

Hello,

For many years now we have been selling on Amazon Canada. We have GST/HST registration, and have tax numbers for BC, QC etc. Amazon collects the GST/HST/QST money, they pass it on to us, and we arrange the filings and submit our payments back to CRA accordingly.

Recently we have decided to remove our BC and QC tax numbers from our Amazon account. We no longer receive the tax collected from sales into these two provinces, our understanding is that Amazon somehow arranges these taxes on their own since the money does not touch our accounts. This is less work for us.

We still have our GST/HST number entered into our account Tax Settings and receive the GST tax into our account. Then we make payments back to CRA. Our thinking is - if we remove the number from our account and Amazon stops sending the collected GST/HST back to us, will they arrange the payments much like they do with BC and Quebec resulting in less money flowing to us and out of us? (we would like that scenario).

Does anyone have any experience with this, opinions, knowledge?

Thanks

GST/HST collection by seller or Amazon

Hello,

For many years now we have been selling on Amazon Canada. We have GST/HST registration, and have tax numbers for BC, QC etc. Amazon collects the GST/HST/QST money, they pass it on to us, and we arrange the filings and submit our payments back to CRA accordingly.

Recently we have decided to remove our BC and QC tax numbers from our Amazon account. We no longer receive the tax collected from sales into these two provinces, our understanding is that Amazon somehow arranges these taxes on their own since the money does not touch our accounts. This is less work for us.

We still have our GST/HST number entered into our account Tax Settings and receive the GST tax into our account. Then we make payments back to CRA. Our thinking is - if we remove the number from our account and Amazon stops sending the collected GST/HST back to us, will they arrange the payments much like they do with BC and Quebec resulting in less money flowing to us and out of us? (we would like that scenario).

Does anyone have any experience with this, opinions, knowledge?

Thanks

5 replies

Seller_jbBO5fX554s05

did you figure this out??

our accountant has just figured out during a GST audit that amazon is collecting our GST but not remitting it back to us, and also not remitting it on our behalf to the CRA. we have about 50k in GST stuck absolutely nowhere???

I need something concrete to tell the CRA

where is the money going???

I have contacted seller support but I would have better luck yelling at clouds. Would appreceate help too!

Jurgen_Amazon

Hello @Seller_i5ZbjMzSTcrhe,

Thank you for contacting Amazon Forums.

I understand you have questions related to taxes in Canada, for this, I have found the Help Page Marketplace Tax Collection for Canada FAQ. The information provided on this page does not constitute tax, legal, or other professional advice and must not be used as such. You should consult your professional tax advisor if you have questions about your personal tax obligation.

Sincerely, Jurgen_Amazon

Seller_WM2gI6zJhp1ha

Amazon moderators are completely unhelpful. ChatGPT could write more useful replies than directing us to the tax page, which we have obviously already read. In fact, it probably is an AI-based response.

Anyway, that is extremely disconcerting if Amazon is collecting the tax and yet not remitting it to the provincial or federal government and not giving it to the merchant to remit directly. Where is this money going?

Seller_WM2gI6zJhp1ha

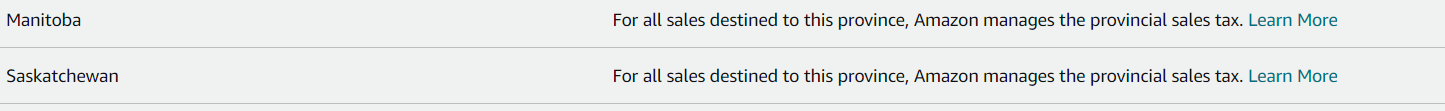

The "Learn More" link leads to this:

"In Canada, Marketplace Tax Collection “MTC” rules mean that in certain cases, Amazon (and not you) is the party responsible for the collection and remittance of Canadian federal and/or provincial sales taxes for the products you sell on the Amazon.ca store."

And some more explanation. Since there no option to even put in a tax number, it seems that Amazon should be taking care of it. They have already deducted the money.

But for BC and Quebec, if you don't put in a tax number, they still deduct the tax from your payout. If you put in a tax number, they will pay it out to you to track and remit yourself.

But if they deduct the tax, and yet don't pay it out to you (as is the case when you don't enter a tax number), then where does the money go??? CRA should seek answers directly from Amazon. It's unreasonable to expect an individual merchant to have a response to this when Amazon is so opaque about how it handles the tax money. Amazon physically holds the tax money, and should be responsible for either paying it out or remitting it to the government.