Tax Codes GST HST

How do we update the Tax Codes and where are the tax codes???

@Daryl_Amazon@Sunnie_Amazon @Jurgen_Amazon@Josh_Amazon

As previously communicated, the Canadian government has announced temporary relief of Goods and Services Tax and Harmonized Sales Tax (GST/HST) for certain products that are sold between December 14, 2024, and February 15, 2025.

Action required by December 14:

Check if your products are eligible for GST/HST relief on the Canada Revenue Agency website.

Review product tax codes for eligible products and update them, if necessary.

Our records indicate that you offer at least one of the eligible product types listed below on Amazon.ca:

Children’s toys and games (designed for children under 14)

Video game consoles, controllers and physical game media (like video game discs and cartridges)

Jigsaw puzzles

Audiobooks

Christmas and holiday trees (including artificial trees)

You can now update these products with newly generated product tax codes.

If you don’t update your product tax codes for eligible products by December 14, 2024, you may be required to reimburse the GST/HST that was charged incorrectly to buyers. We recommend that you contact your tax adviser to understand the impact on your business.

For more information, including affected product tax codes, instructions on how to update them and frequently asked questions, go to Temporary GST/HST relief in Canada.

If you’ve already updated your product tax codes or you don’t sell products in the categories listed above, you can disregard this email.

The Amazon Services team

Tax Codes GST HST

How do we update the Tax Codes and where are the tax codes???

@Daryl_Amazon@Sunnie_Amazon @Jurgen_Amazon@Josh_Amazon

As previously communicated, the Canadian government has announced temporary relief of Goods and Services Tax and Harmonized Sales Tax (GST/HST) for certain products that are sold between December 14, 2024, and February 15, 2025.

Action required by December 14:

Check if your products are eligible for GST/HST relief on the Canada Revenue Agency website.

Review product tax codes for eligible products and update them, if necessary.

Our records indicate that you offer at least one of the eligible product types listed below on Amazon.ca:

Children’s toys and games (designed for children under 14)

Video game consoles, controllers and physical game media (like video game discs and cartridges)

Jigsaw puzzles

Audiobooks

Christmas and holiday trees (including artificial trees)

You can now update these products with newly generated product tax codes.

If you don’t update your product tax codes for eligible products by December 14, 2024, you may be required to reimburse the GST/HST that was charged incorrectly to buyers. We recommend that you contact your tax adviser to understand the impact on your business.

For more information, including affected product tax codes, instructions on how to update them and frequently asked questions, go to Temporary GST/HST relief in Canada.

If you’ve already updated your product tax codes or you don’t sell products in the categories listed above, you can disregard this email.

The Amazon Services team

0 replies

Seller_30jLPwzefZQ9L

I would love to know this as well...Thank you!!!

Seller_0ZWgQmSO8F8T2

Does this have to be done for FBA products, or just FBM. Since Amazon calculates the taxes on FBA, is it their responsibility to adjust?

Thanks

Seller_mU6MpQQeQAHMR

Seller_30jLPwzefZQ9L

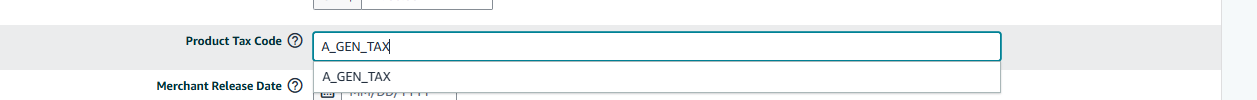

Tammy_ you have to go into each individual listing and edit them. Under offers there is a " PRODUCT TAX CODE" right underneath "LISTING PRICE" .....Click on PRODUCT TAX CODE and it will turn into a drop menu. Scroll down until you see A_GEN_NOTAX and click that.

You can double check and see if it worked by asking someone to place that item in their cart and go to checkout without buying. There will be no tax on at the checkout.

This has to be done to all of our individual listing for toys

Hope this helped

Seller_NzjvFczEXAcnJ

@Daryl_Amazon @Sunnie_Amazon @Jurgen_Amazon @Josh_Amazon - Can you please help us on the steps to update the tax code in bulk for all the active listings ? Manual approach to single-single listing is very time consuming.

Sellers, have you found any way to do it in bulk ?

Seller_tYggsIdI0Ie18

Amazon handled this about as bad as they could have by not providing a method to bulk update listings. No seller of any repute has time to manually change several hundred listings over *one at a time*, and then repeat the process two months later!