Import Duties on Returns from Canada to US

Hi,

Consider a seller selling on Amazon.ca, and shipping the orders from a US warehouse (i.e. FBM). In the case they get returns from Canadian customers, they have to accept them. However, every time the seller must pay import duties (from Canada to the US) on the return. Has anyone fixed this issue for themselves?

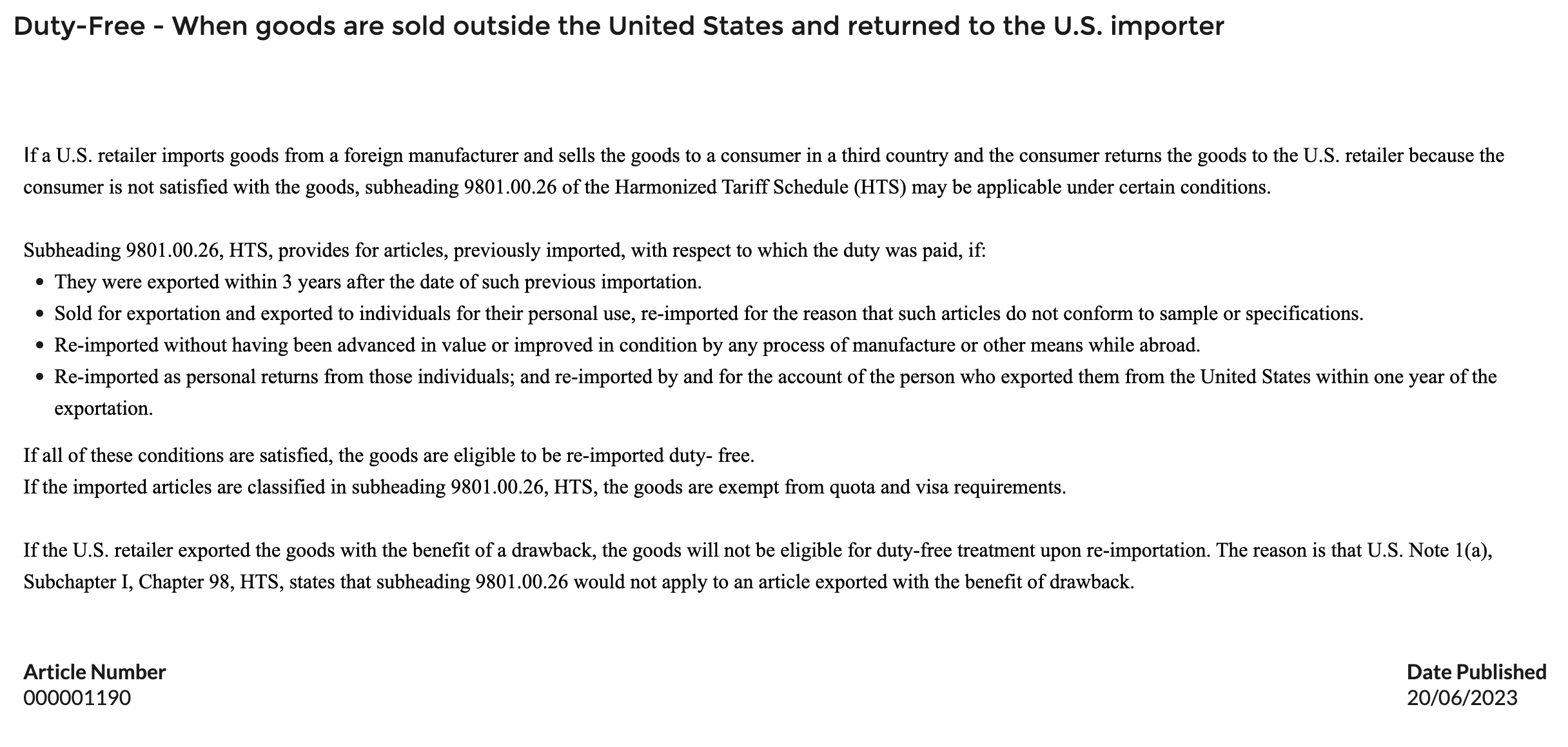

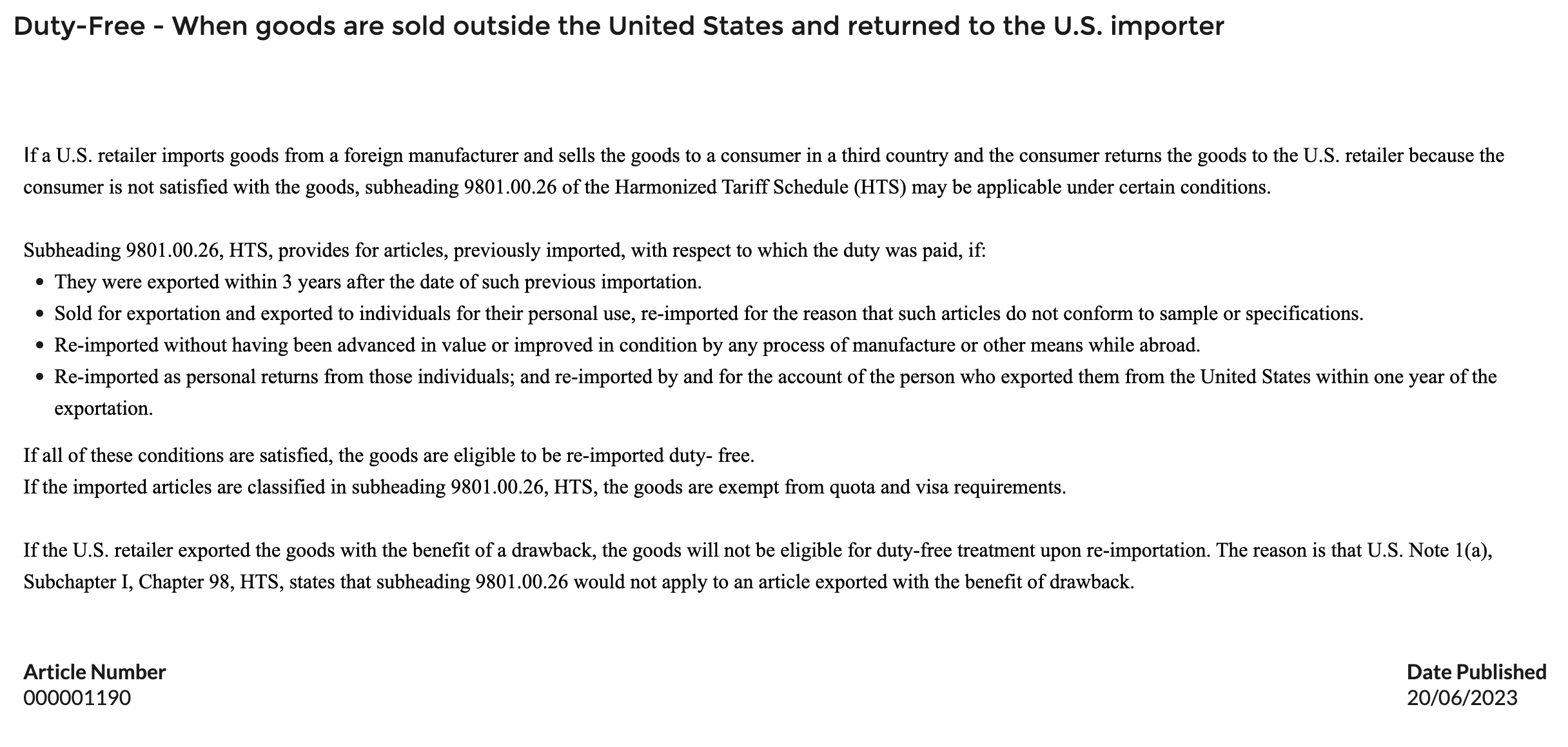

According to the screenshot below (I can't past the link here but you can find it by searching the title), it seems we can get an import duty exemption for precisely this reason (when re-importing back to the US). Has anyone tried this? Is it as easy as entering the desired HS code in the Commercial Invoice? Do we need to provide any other documents to prove that we fulfill the requirements? This method seems the easiest to achieve what I want.

Any information is welcome, thanks!

Best,

Peter

Import Duties on Returns from Canada to US

Hi,

Consider a seller selling on Amazon.ca, and shipping the orders from a US warehouse (i.e. FBM). In the case they get returns from Canadian customers, they have to accept them. However, every time the seller must pay import duties (from Canada to the US) on the return. Has anyone fixed this issue for themselves?

According to the screenshot below (I can't past the link here but you can find it by searching the title), it seems we can get an import duty exemption for precisely this reason (when re-importing back to the US). Has anyone tried this? Is it as easy as entering the desired HS code in the Commercial Invoice? Do we need to provide any other documents to prove that we fulfill the requirements? This method seems the easiest to achieve what I want.

Any information is welcome, thanks!

Best,

Peter

2 replies

Bryce_Amazon

Greetings @Seller_WVPuV2z92rU0H,

Thanks for posting, and apologies this didn't get a lot of traction. I did some research into the questions you asked, but was unable to find other examples of sellers going through this process.

This section in the Amazon tax policies (along with several threads over the years about Canada and duty taxes) makes me think this might not be possible:

"Shipping Products Internationally

When fulfilling product from a country outside the order origin country (elected country), you are the importer of goods to the elected country and responsible for the payment of all import duties, taxes, and custom fees (collectively “Customs Fees”). If you fulfill product to an address outside your elected country, generally, you are considered the exporter and the buyer is considered the importer. The seller is responsible for export Customs Fees (if any) and the buyer is responsible for any import Customs Fees related to their purchase. Customs Fees paid by any party (if any) are in addition to the sales proceeds collected by Amazon. For more additional information about shipping products internationally, see Important information for international sellers."

I hope this helps, let me know if you have any additional thoughts.

- Bryce