Link My Books Software

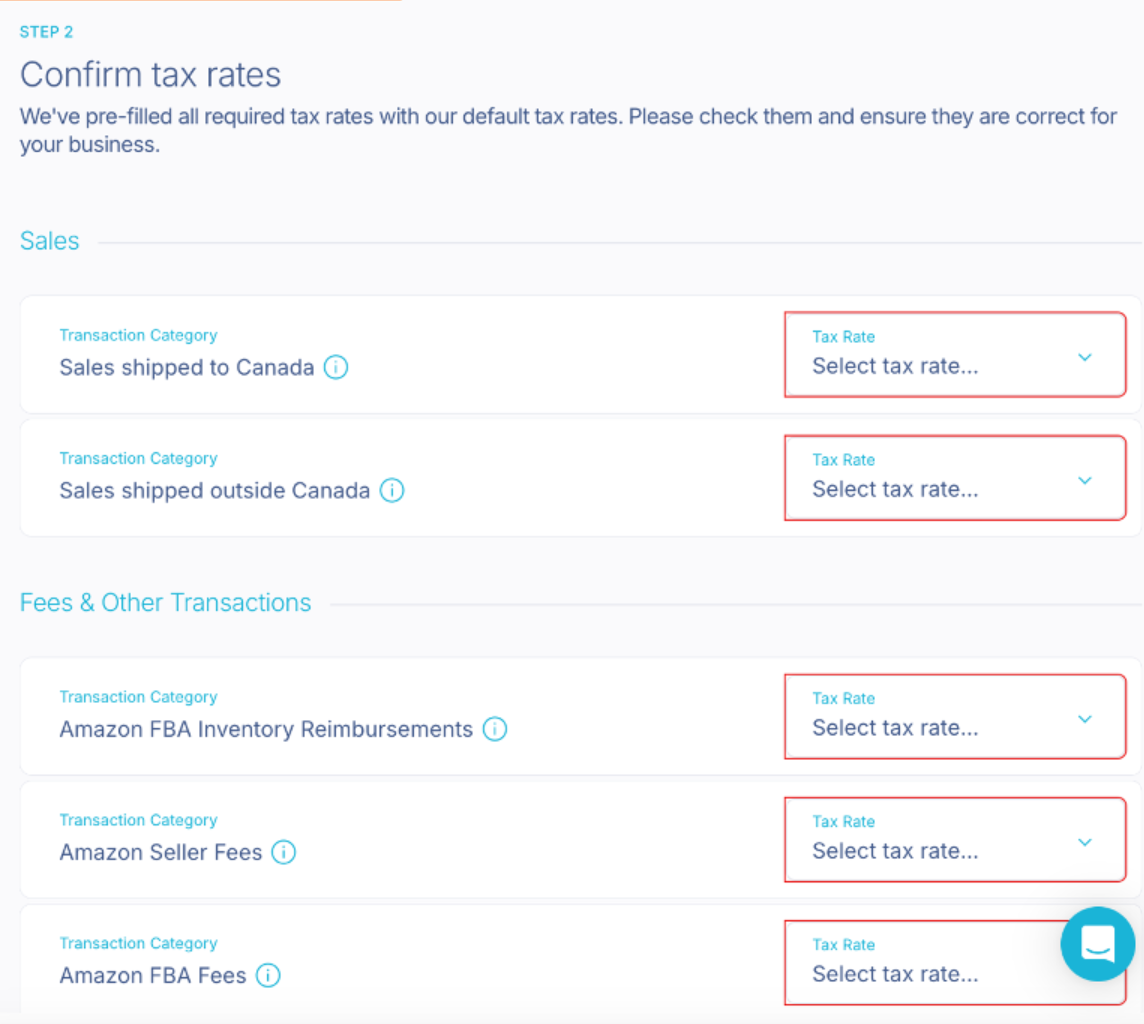

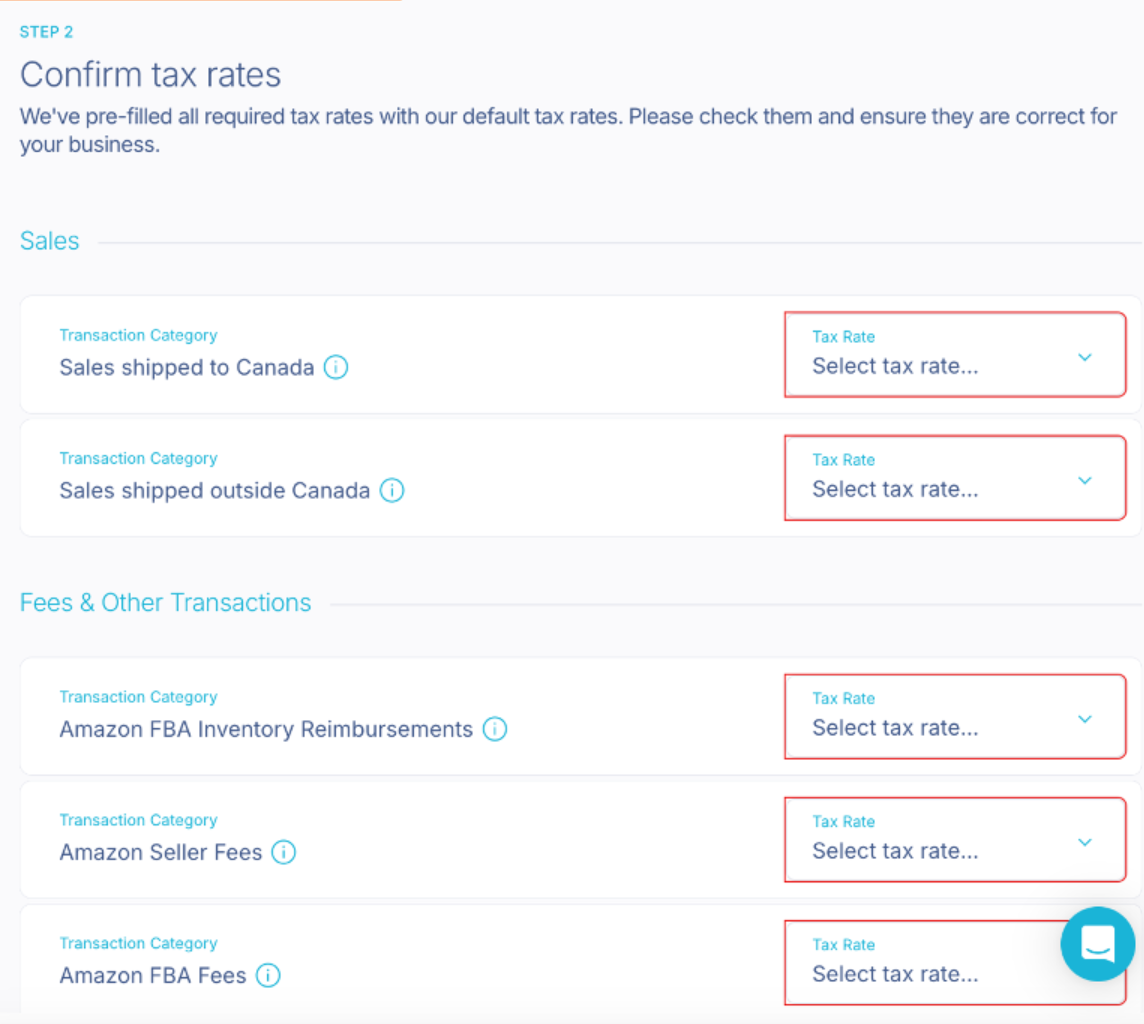

I'm seeking some advice regarding tax rate settings within "Link My Books". (which is an alternatie software to A2X)

My business is incorporated in Canada, but all of our sales are conducted exclusively through Amazon USA marketplace. I’ve recently started using "Link My Books" to streamline our bookkeeping, but I’m uncertain about how to correctly configure the tax rates.

For those familiar with Canadian businesses operating in the U.S. via Amazon, or anyone experienced with this platform—should I be applying the tax rates based on the Canadian province in which my business is incorporated, or should I be configuring U.S. sales tax rates instead?

Any insights or guidance would be greatly appreciated.

Cheers

Link My Books Software

I'm seeking some advice regarding tax rate settings within "Link My Books". (which is an alternatie software to A2X)

My business is incorporated in Canada, but all of our sales are conducted exclusively through Amazon USA marketplace. I’ve recently started using "Link My Books" to streamline our bookkeeping, but I’m uncertain about how to correctly configure the tax rates.

For those familiar with Canadian businesses operating in the U.S. via Amazon, or anyone experienced with this platform—should I be applying the tax rates based on the Canadian province in which my business is incorporated, or should I be configuring U.S. sales tax rates instead?

Any insights or guidance would be greatly appreciated.

Cheers