Resale Tax Exemption

Resale Tax Exemption

2 replies

Seller_kIukTwdhvntAp

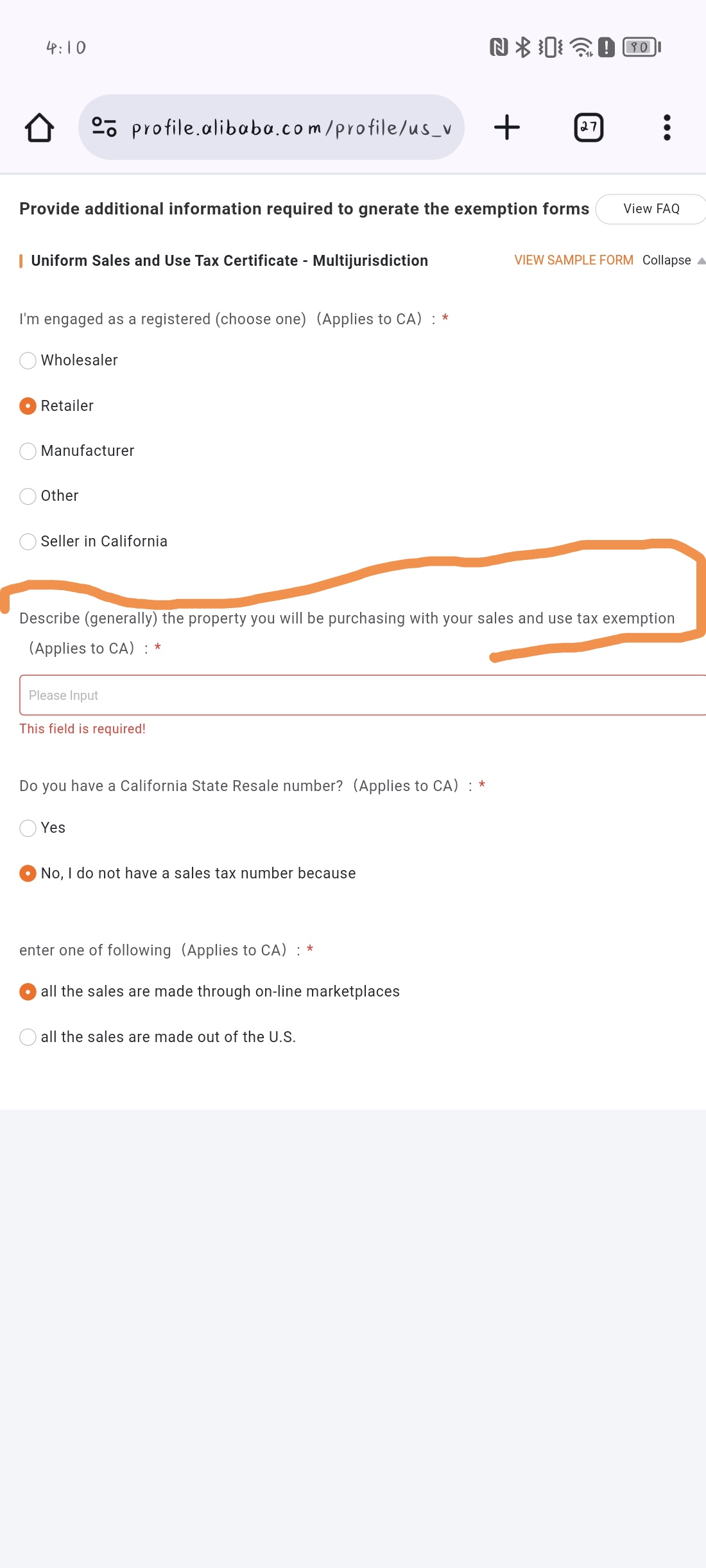

"where i get Sale Tax Exemption"

You register with your STATE.

If you are REALLY going to buy from ALI@#$@$$ just start writing your "please help with my Section 3 suspension'" letter since they are well known for IP violations, knockoffs, counterfeits, and virtually every other type of fake items that are out there.

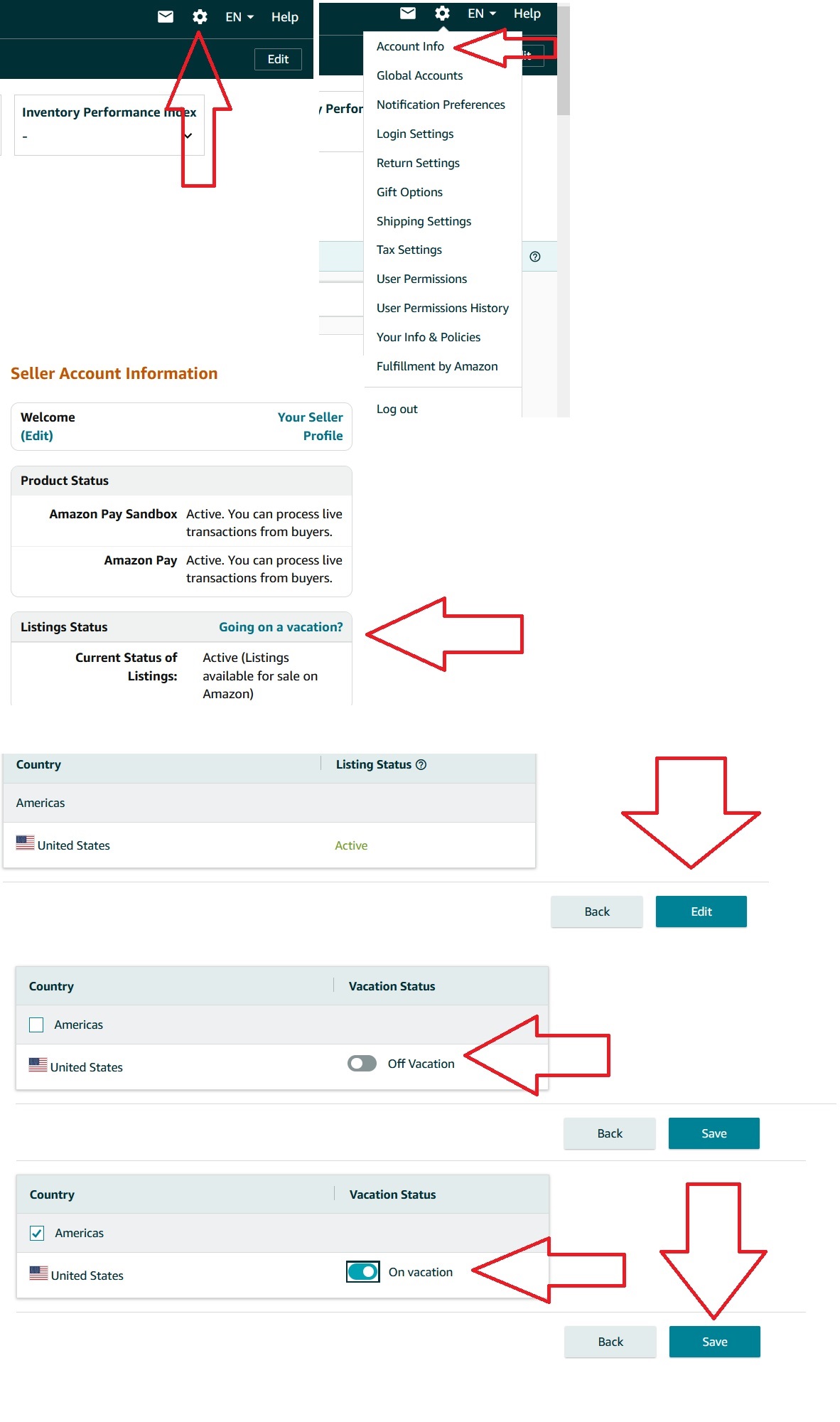

VACATION MODE NOW.

SELLER U NOW.

https://sell.amazon.com/learn

Seller_Hi7wbO2Kbo6bl

In addition to what NEVERLAST warns about, I will add you should not be contemplating opening a business without a resale license. Even though you are no longer responsible for collecting and remitting for Amazon sales you are responsible for filing a report. Or at least are responsible if that screenshot shows your correct state. Many other states also require a filed report even though nothing may be owing.

You must have this license for business. You must have this license for any wholesale purchasing.